WELCOME ADDRESS

By

The Executive Governor of The Central Bank of Liberia

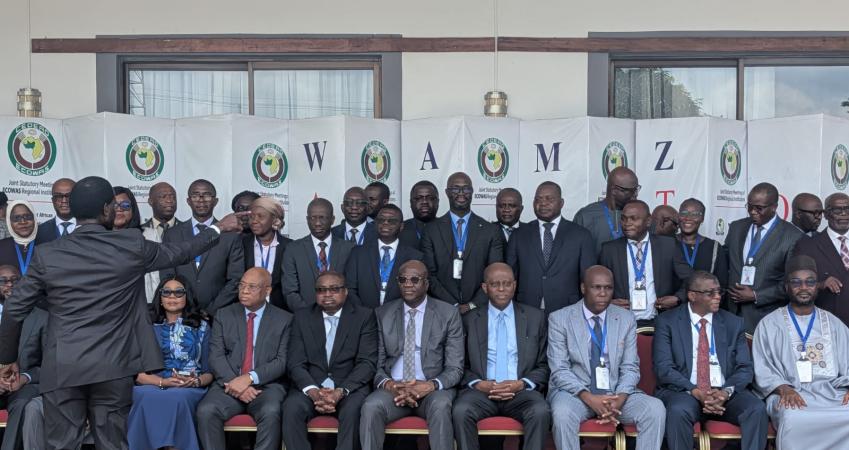

At The Joint Opening Ceremony of the Sixty Seventh (67th) Ordinary Meeting of The Committee of Governors of Central Banks of ECOWAS Member States (WAMA)/ Fifty Second (52nd) Meeting of Committee of Governors of the West African Monetary Zone (WAMI)/ Fiftieth (50th) Board of Governors’ Meeting of the West African Institute for Financial and Economic Management (WAIFEM)

February 12, 2026

MONROVIA, LIBERIA

Honorable Chairman

Esteemed Members of the Committee of Governors

Members of Parliament of the Sub-Region, here present

Representative of the President of the ECOWAS Commission

Director Generals of WAMA, WAMI, and WAIFEM

Representative of the President of the UEMOA Commission

Representatives of Other Regional and International Organizations

Representatives of Ministries, Departments, and Agencies

Distinguished Delegates

Members of the Fourth Estate

Ladies and Gentlemen.

It is with profound honor and a deep sense of responsibility that I welcome you distinguished dignitaries to this historic joint opening ceremony of the 67th Ordinary Meeting of the Committee of Governors of the Central Banks of ECOWAS Member States , the 52nd Meeting of the Committee of Governors of the West African Monetary Zone (WAMI), and the 50th Meeting of the Board of Governors of the West African Institute for Financial and Economic Management (WAIFEM). Today, as we gather under the banner of regional cooperation and shared destiny, we reaffirm our collective commitment to building a resilient, integrated, and prosperous West Africa.

We gather here not only as technocrats and policymakers, but as custodians of a vision—one that seeks to bind our nations together in prosperity, resilience, and shared destiny as envisaged by our forebears.

As we gather in the Capital City of the Republic of Liberia, Africa’s oldest Republic, and one of the touch bearers of African unity, we, on behalf of the President of the Republic of Liberia, His Excellency Joseph Nyuma Boakai, Sr., the Government and People of Liberia warmly welcome you to this historic city of Monrovia, a city named after James Monroe, the 5th President of the United States of America, reflecting the long years of historical ties between the US and Liberia.

We, also on behalf of the Central Bank of Liberia family, extend our warm greetings and sincere appreciation to our fellow Governors and the distinguished members of the various delegations who have travelled from within and beyond our sub- region to convene in Monrovia.

For Liberia, President Boakai affirms that hosting these landmark meetings is both a privilege and a responsibility. “We stand ready to contribute meaningfully to the discourse and to the decisions that will shape the financial future of our region, recognizing that our collective strength lies not in isolation but in solidarity”.

Today, as we gather here in Monrovia, we reaffirm our collective commitment to building a stronger, more resilient, and more integrated West Africa. These meetings are not merely statutory obligations; they are milestones in our shared journey toward monetary cooperation, financial stability, and the long-standing aspiration of a single regional currency.

Our gathering is not merely ceremonial—it is a testament to the enduring vision of our forebears who believed in the power of unity. As former ECOWAS Secretary-General Dr. Abass Bundu once remarked, “Regional integration is not an option for West Africa; it is an imperative for survival in a globalized world.” His words remind us that our unity is not simply desirable, it is essential.

Similarly, Ghana’s first President, Dr. Kwame Nkrumah, declared decades ago: “The forces that unite us are intrinsic and greater than the superimposed influences that divide us.” This timeless wisdom continues to guide our efforts today, as we strive to overcome national barriers in pursuit of collective prosperity as well as remind us that our economic and monetary collaboration is not optional, but essential.

Our institutions—WAMA, WAMI, and WAIFEM—are and remain the pillars upon which this vision rests. They provide technical expertise, policy frameworks, and capacity-building initiatives that enable us to move forward. As former Senegal’s President Macky Sall noted in his call for deeper cooperation, “Africa must speak with one voice in the global financial system if we are to be heard and respected.”

These institutions embody our determination to harmonize monetary policies, strengthen financial systems, and build capacity across member states. In doing so, we are laying the foundation for a common destiny.

Mr. Chairman, Honorable Governors, Members of Parliament, and Distinguished Delegates,

We convene at a time of numerous challenges and opportunities. Global economic uncertainties, climate shocks, and technological disruptions are tests to our resilience.

Yet, within these challenges lie opportunities to innovate, to deepen intra-regional trade, and to harness digital finance for inclusive growth. Our dream of a unified monetary zone may be ambitious, but it is achievable if pursued with courage, discipline, and vision. Others have done it, so too can we!

Today, the numbers we see are telling a sobering story: global growth is steady at 3.3 percent in 2025 and will likely remain unchanged in the medium term. This performance reflects the balancing of divergent global factors, including shifting trade policies, geo-political tensions, accommodative financing conditions and increasing investments in technology.

While global inflation is trending downward from 5.8 percent in 2024 to a projected 4.1 percent and 3.8 percent in 2025 and 2026, significant vulnerabilities still exist. Advanced economies continue to wrestle with service sector inflation and wage pressures, while many of our own economies face the dual challenges of currency depreciation and food price volatility. The apparent easing of global financial conditions, including a weaker US dollar, provides some relief but conceals underlying risks of sudden market adjustments that could rapidly destabilize capital flow to our region.

Yet and against this challenging backdrop, we are proud to say that our region has demonstrated remarkable resilience. ECOWAS economies grew by 4.5 percent in 2025, stronger than 4.4 percent in 2024, and with a projected 5.0 percent growth in 2026. This remarkable performance relative to global trends is no accident. It reflects deliberate policy choices, improved coordination among our Central Banks and relevant authorities, and the reform efforts that many of our Member States have undertaken despite difficult domestic circumstances.

Mr. Chairman, Honorable Governors, Members of Parliament, Distinguished Delegates,

One of our most significant achievements is containing inflation. The regional average inflation has fallen from 23.3 percent in 2024 to 16.8 percent in 2025, with further moderation expected in 2026. While these figures remain above our regional convergence target, the trajectory is encouraging and reflects the effectiveness of coordinated monetary policies across our member states.

Each of our Central Banks has adopted and tailor monetary policy to national circumstances while maintaining alignment with our regional objectives. This differentiated, yet coordinated approach has allowed us to address inflation, while supporting economic recovery; a delicate balance that requires continuous vigilance and frequent consultations amongst ourselves and our fiscal counterparts.

A spectrum on the broader monetary landscape has shown that exchange rate stability has improved across most of our jurisdictions, external reserves have strengthened, and financial systems have generally remained sound. These are not merely technical achievements; they represent restored confidence, improved living standards for our citizens, and a more favorable environment for the private sector investment that our economies need.

Mr. Chairman, Honorable Governors, Members of Parliament, Distinguished Delegates,

Fiscal performance across our sub-region has also improved. The consolidated fiscal deficit narrowed to 3.1 percent of GDP in 2025 from 4.8 percent in 2024, with continued improvements expected in 2026, bringing us significantly closer to our 3.0 percent convergence criteria.

Enhanced revenue mobilization has been key, driven by stronger tax administration, improved customs performance, and better non-tax revenue collection, demonstrating that our domestic revenue mobilization strategies and policies are working. We need to stay the course.

Having said that, we must note that expenditure pressures remain intense across our Member States. Recurrent spending continues to absorb a large share of budgets, leaving limited fiscal space for the infrastructure and social investments that our economies require. This is a structural challenge that will require sustained attention and, in some cases, difficult political choices about expenditure priorities and revenue enhancement.

Our debt metrics show cautious improvement. The regional debt-to-GDP ratio is expected to decline to 42.3 percent in 2025, reflecting GDP growth and more prudent debt management. Nevertheless, debt service obligations remain burdensome for several member states, and we must remain committed to prioritizing concessional financing and enhancing debt transparency.

External sector performance remains a source of strength. Export growth of 17.51 percent significantly outpaced import growth of 6.94 percent, contributing to a regional current account surplus of 3.5 percent of GDP. Commodity exports, particularly gold and cocoa, have performed well, and this has supported reserve accumulation across the region.

Most member states now maintain reserves above 3 months of import cover, meeting our convergence benchmark. Some countries have implemented innovative approaches, such as gold reserve accumulation programs, to bolster their reserve positions. These improvements in external buffers provide important safeguards against potential external shocks, demonstrating our commitment to macroeconomic resilience.

On convergence performance specifically, the progress is noteworthy. Four member states were expected to meet all 4 primary criteria in 2025, doubling the number for 2024, while five member states were estimated to meet 3 primary criteria, two Member States met two primary criteria and one Member State met only one primary criteria.

These are not just mere statistics; they represent real progress towards macroeconomic stability that will underpin our monetary union.

Mr. Chairman, Honorable Governors, members of parliament, Distinguished Delegates,

Allow me to briefly update you on Liberia's economic performance and our contributions to the regional integration efforts.

Liberia's economy was estimated to grow by 5.1 percent in 2025, up from 4.0 percent in 2024, exceeding both our regional average and global growth trends. The Liberian industrial sector has also shown strength, particularly in mining, where iron ore and gold exports have performed robustly, recording a 17.0 percent growth in 2025, from 2.1 percent in 2024.

On inflation, we were faced with some challenges at the inception of 2025, but policy coordination with the fiscal authorities helped to moderate inflation in the second half of the year.

Average inflation in 2025 stood at 8.5 percent, marginally above 8.3 percent in 2024, and still above the 5.0 percent convergence target. Non-food inflation has been particularly persistent, though food inflation declined significantly to 5.5 percent in June 2025 from 11.6 percent in June 2024, reflecting improved domestic food supply. Consequently, inflation averaged 4.4% in the last quarter of 2025, with end period inflation at 4%.

The Central Bank of Liberia has maintained a tight monetary policy stance which has partly contributed to the easing of inflationary pressures. Accordingly, the monetary policy committee reduced the policy rate from 20.0 percent at end-June 2024 to 17.25 percent in April 2025, and further to 16.25 percent in October 2025 to support credit expansion and economic activity. At its first quarter sitting in early 2026 the Committee maintained the MPR at 16.25 percent with the aim of managing potential inflation expectation.

Fellow Governors, we are pleased to highlight that fiscal performance strengthened in 2025 due to improved revenue mobilization and discipline expenditure measures. Total government revenue and grants rose by 18.6 percent in the first half of 2025, enabling Liberia to achieve a balanced budget, well within the three percent ECOWAS threshold.

The stock of public debt was estimated to decline to 54.2 percent of GDP, further strengthening compliance with the ECOWAS convergence benchmark. These ratios, deficit to GDP and debt to GDP, place Liberia among the best performing budget deficit and debt sustainability countries of the convergence criteria.

Liberia’s external sector performance was robust in 2025. Exports rose by over 30 percent, gross external reserves increased by US$101 million to US$575.5 million, the net international reserves surpassed the IMF-agreed target of US$266 million by almost US$16 million at end December 2025 from US$234 million recorded in 2024. The Liberian dollar depreciated by only 0.9 percent against the US dollar, complying with ECOWAS secondary criterion of plus/minus 10 percent exchange rate variation. However, on an end-period basis, the Liberian dollar appreciated by 3.2 percent, compared to December 2024.

The banking system remains sound and stable. Capital adequacy and Liquidity ratios stood at 37.9 percent and 50.1 percent respectively, far above the minimum regulatory threshold. Non-performing loans, declined from 17.9 percent at end December 2024 to 12.58 percent at December 2025, manifesting targeted measures by the CBL to improve asset quality and unlock credit to the private sector, as the “engine of growth”.

On the Convergence front, overall, Liberia met 4 of the 6 convergence criteria: 2 of the 4 primary criteria and all the secondary criteria. We are making substantial progress to bring inflation down to the regional benchmark of at most 5 percent in the medium term.

Mr. Chairman, Honorable Governors, Members of Parliament, Distinguished Delegates,

Being mindful of our progress, we cannot rest on our laurels as significant challenges remain. First, achieving the inflation criterion will require sustained monetary discipline, continued coordination among our Central Banks, and supportive fiscal policies considering the complimentary role of fiscal and monetary policies.

Second, fiscal deficits in many Member States remain above target, despite recent improvements. The pressures are real as the demands for public services, infrastructure needs, and social programs compete for limited resources. We must find ways to enhance revenue mobilization, improve expenditure efficiency, and create fiscal space for productive investments.

Third, debt sustainability concerns persist. While regional debt ratios have improved, several Member States face heavy debt service burdens. We must continue prioritizing concessional financing, improving debt management capacity, and enhancing transparency about debt obligations.

Fourth, external vulnerabilities remain. Our economies are heavily dependent on unprocessed commodity exports. We remain exposed to price shocks and global demand fluctuations. Building adequate external buffers and diversifying our economies must remain priorities.

Mr. Chairman, Honorable Governors, Members of Parliament, Distinguished Delegates,

On the institutional preparations for our monetary union, we have been reliably informed about the achievement of significant milestones.

While the Central Bank of West Africa (CBWA) capital requirement of USD 187 million and reserves pooling arrangement of USD 4.5 billion have been determined and approved, the monetary union agreement and CBWA Statute are ready for adoption. The legal framework of the ECOWAS Solidarity and Stabilization Fund, with USD 1.252 billion in capital, is also ready for adoption. Our monetary policy framework based on inflation targeting is substantially complete.

However, we are still confronted by critical bottlenecks that have implications for the 2027 timeline for the launch of our Single Currency, the ECO.

After several years of discussions, we still have not agreed on the host country of the CBWA headquarters. This is a matter of concern and urgency, as it may affect institutional planning and the operational readiness of our future Central Bank.

Similarly, the implementation of the ECOWAS Payment and Settlement System (EPSS) has been delayed due to funding constraints coupled with the pending decision on the selection of the host country for the EPSS. Thus, we are advancing our advisory for political commitment to mobilize the necessary resources.

Just as we are prioritizing the enhancement and strengthening of our respective national payment infrastructures, we should prioritize the EPSS too. The EPSS can unlock a lot of opportunities for inter-regional trade and strengthen monetary union among in our Member States.

Given these institutional bottlenecks, combined with the macroeconomic convergence gaps, we must be realistic about our timeline and strategy for the Single Currency Project, while remaining committed to our ultimate objective.

The pursuit of a single currency within ECOWAS has been a long-standing dream. As Nigeria’s former President Olusegun Obasanjo once emphasized, “Economic integration is the surest path to political stability and sustainable development in West Africa.” His conviction underscores the importance of our work here—to harmonize monetary policies, strengthen financial institutions, and ensure that our economies can withstand global shocks.

Mr. Chairman, Honorable Governors, Members of Parliament and Distinguished Delegates,

The people of West Africa are watching us. They have entrusted us with the responsibility of managing their currencies, maintaining price stability, and supporting economic growth. They expect us to deliver on the promise of regional integration, not through rhetoric, but through concrete actions that improve their lives and livelihoods.

Our mandate is clear. We are here to harmonize monetary policies, strengthen financial systems, and build capacity across our Member States. But beyond the technical language lies a deeper purpose: the creation of a West Africa that is economically integrated, financially stable, and socially inclusive.

Former Nigerian President Olusegun Obasanjo also once said: “We must not only integrate our economies, but also our hearts and minds, for integration without solidarity is hollow.” Let us take those words to heart. For without solidarity, our convergence criteria are just numbers; with solidarity, they become the foundation of transformation.

The key question that we need to grapple with is: Do we need to take a look at our strategy toward the Single Currency Programme? What lessons can we learn from other monetary unions? We have a couple of them on our continents, including our own BCEAO.

As we bring this welcome statement to a close, we urge all of us to approach these deliberations with renewed vigor, guided by the wisdom of our leaders, past and present, and the aspirations of our people. Let us ensure that when history looks back on this moment, it will say that West Africa chose cooperation over fragmentation, resilience over vulnerability, and unity over division.

As Nelson Mandela once said, though he spoke for all of Africa: “It always seems impossible until it is done.” May our work here prove that the impossible is within our grasp.

Mr. Chairman, Honorable Governors, Members of Parliament, Distinguished Delegates, welcome and thank you for your kind attention! Please feel at home and enjoy the warm hospitality of the Liberian people.